We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our new to forex guide.Explore these thoroughly to find out if this type of analysis suits your personality Technical traders have different styles and forex trading strategies.Explore the fundamentals of the standard moving average as well is implementing the 200-day moving average into your trading.Look to enter ‘long’ or ‘short’ positions accordinglyīecome a Better Trader with Our Trading Tips.Identify crossing points between shorter term EMA’s and longer term EMA’s.Use long-term EMA to identify general trend.Steps to follow when trading with the EMA:

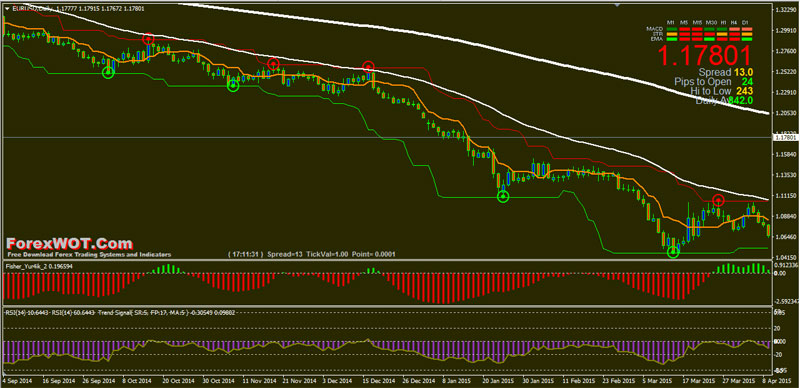

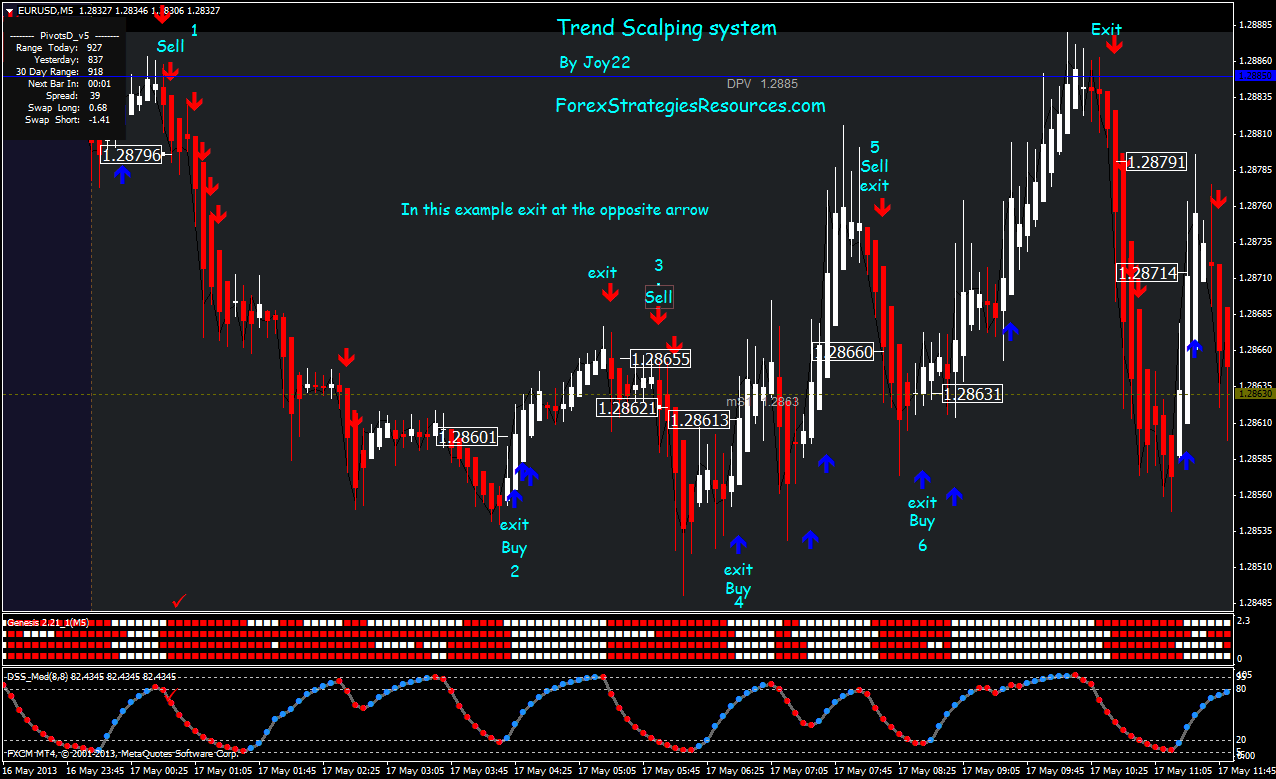

More experienced traders tend to use the EMA in conjunction with other tools, but this makes it no less influential. This indicator is simple to use and a great way for novice traders to get a feel for technical analysis in relation to identifying trends and entry prospects. The EMA is valuable indicator to have as a trader. The circle represents a ‘buy’ opportunity with the 20 EMA crossing above the 50 EMA line. Highlighted above shows a probable entry point indicating a ‘buy’ signal. Once the trend is confirmed, traders utilise the shorter term EMA’s to identify possible entry points. Thereafter price resumes its trajectory above the 200 EMA confirming the upward trend. In this case price is above the 200 EMA from 2014 to mid-2017 (upward trend), after which the price crosses through representing no clear trend. The 200 EMA is used to identify the overall long-term trend. The chart above depicts a USD/CAD daily chart with the 20, 50 and 200 EMA indicator added. The example below uses 20, 50 and 200 EMA designations, while other traders favour Fibonacci figures. The EMA values are completely up to the trader’s preferences. When the shorter term EMA crosses below the longer term EMA, traders look to enter short positions. When the shorter term EMA crosses above the longer term EMA, this signals a buy signal. The EMA trading strategy can be used in the same manner as the SMA. How do you use the Exponential Moving Average in your trading strategy? The formula below breaks down the components of the calculation making it easy to visualize and compute. The exponential moving average (EMA) is a weighted moving average calculated by taking the average price for a particular market over a defined period of time and adjusting this figure to increase the weight of recent price data. For the numbers people, the formula will be shared below, but the important thing to remember is that EMA will react quicker to price trends relative to SMA. Nearly all charting packages perform this calculation on the respective platforms and apply the calculation to the chart. How is the Exponential Moving Average (EMA) Calculated? The same is seen with an increase in price emphasizing the variance in lag. The 200-EMA is seen reacting earlier to the highlighted decline in price on the left side of the chart. The chart below represents the difference between the SMA and EMA. This means that the EMA is more responsive than the SMA to current price fluctuations. Compared to the SMA, the EMA weighs recent price changes more heavily than later changes in price. The exponential moving average (EMA) is a derivative of the simple moving average (SMA) technical indicator. What is Exponential Moving Average (EMA)?

0 kommentar(er)

0 kommentar(er)